Edmonton, the capital city of Alberta, is known for its vibrant culture, beautiful landscapes, and a strong economy driven by the oil and gas industry. As more people consider relocating to this lively city, understanding the cost of living in Edmonton becomes crucial for making an informed decision. This comprehensive guide will explore various aspects of living costs in Edmonton, from housing and utilities to transportation, groceries, and beyond.

When moving to a new city, budgeting effectively can significantly impact your quality of life. By examining the cost of living in Edmonton, you can plan your finances better and ensure a smooth transition. Whether you’re a single professional, a couple, or a family, this guide aims to provide a detailed breakdown of the cost of living in Edmonton, helping you manage your budget and enjoy everything this city has to offer.

Looking for a good place to live and affordable? Buckle up! This guide will explore the costs associated with housing in Edmonton, including rental, purchase prices and more.

Immigration news directly into your inbox

Housing: Rental and Purchase Prices

When considering a move to Edmonton, one of the most significant expenses to factor in is housing. The cost of living in Edmonton heavily depends on whether you choose to rent or purchase a home. Understanding the current market trends can help you make an informed decision.

Rental Prices

Renting a property in Edmonton offers flexibility, especially for newcomers. The rental market in Edmonton varies depending on the neighborhood, property type, and amenities offered. On average, here are the approximate monthly rental costs:

- One-bedroom apartment in the city center: CAD 1,375 – CAD 1,875

- One-bedroom apartment outside the city center: CAD 1,125 – CAD 1,500

- Three-bedroom apartment in the city center: CAD 2,250 – CAD 3,125

- Three-bedroom apartment outside the city center: CAD 1,750 – CAD 2,500

These figures provide a general idea, but it’s always advisable to research specific areas and compare prices.

Purchase Prices

For those looking to buy a home, Edmonton offers a range of options from modern condos to family houses. The real estate market in Edmonton is relatively affordable compared to other major Canadian cities. Here’s an overview of average home prices:

- Single-family detached home: CAD 400,000 – CAD 500,000

- Condominium: CAD 200,000 – CAD 300,000

- Townhouse: CAD 300,000 – CAD 400,000

Prices can vary significantly based on the neighborhood, property size, and market conditions. Consulting with a local real estate agent can provide more accurate and up-to-date information.

Understanding the housing market is crucial for accurately assessing the cost of living in Edmonton. Whether you choose to rent or buy, knowing the average prices can help you budget accordingly and make the best decision for your lifestyle and financial situation.

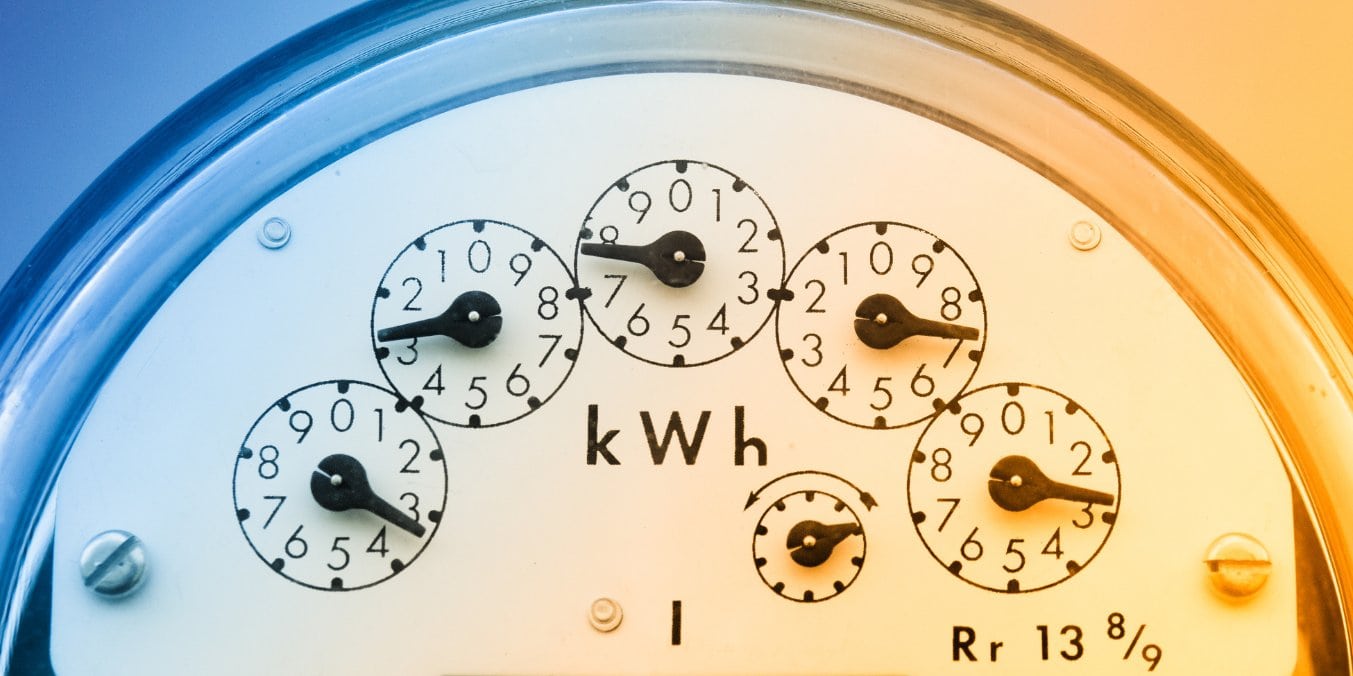

Utilities: Electricity, Gas, Water, and Internet

Once you’ve secured housing, the next essential aspect of the cost of living in Edmonton is utilities. These recurring monthly expenses can add up, so it’s important to understand what to expect.

Electricity

Electricity costs in Edmonton can vary depending on the size of your home and your usage patterns. On average, a typical household can expect to pay around CAD 70 to CAD 120 per month for electricity. Energy-efficient appliances and mindful usage can help keep these costs manageable.

Gas

Natural gas is a common source of heating in Edmonton, especially during the cold winter months. The average monthly gas bill for a household ranges from CAD 80 to CAD 150, depending on the size of the home and insulation quality. The use of programmable thermostats can help in reducing these expenses.

Water

Water bills in Edmonton are relatively modest. The average monthly cost for water, including sewer services, is typically between CAD 40 and CAD 60. Efficient water usage and fixing any leaks promptly can help keep these costs down.

Internet

High-speed internet is a necessity for most households. In Edmonton, the average cost of internet service ranges from CAD 60 to CAD 100 per month, depending on the speed and provider. Many providers offer bundled services, which can include internet, cable TV, and phone services, often at a discounted rate.

Understanding these utility costs is crucial for managing your overall budget and accurately assessing the cost of living in Edmonton. By being aware of these expenses, you can plan better and make informed decisions about your monthly spending.

Transportation: Public Transit and Car Ownership Costs

Transportation is another key factor when considering the cost of living in Edmonton. Whether you rely on public transit or own a car, understanding these expenses will help you budget effectively.

Public Transit

Edmonton has a comprehensive public transit system managed by Edmonton Transit Service (ETS), which includes buses and light rail transit (LRT). Public transit can be a cost-effective and environmentally friendly option for getting around the city. Here’s an overview of the costs:

- Monthly Adult Pass: CAD 100.00

- Monthly Youth Pass (ages 24 and under): CAD 73.00

- Single Ride Ticket: CAD 3.50

- Day Pass: CAD 9.75

For those who frequently use public transit, investing in a monthly pass can offer significant savings. The ETS provides reliable service, connecting various parts of the city, making it a convenient option for many residents.

Car Ownership

Owning a car provides more flexibility but comes with additional costs. Here’s a breakdown of common expenses associated with car ownership in Edmonton:

- Fuel: The average cost of gasoline in Edmonton is around CAD 1.20 to CAD 1.50 per liter. Monthly fuel costs can range from CAD 100 to CAD 200, depending on your driving habits.

- Insurance: Car insurance premiums in Alberta can vary widely based on factors like your age, driving record, and the type of vehicle. On average, expect to pay between CAD 100 and CAD 200 per month for insurance.

- Maintenance and Repairs: Routine maintenance (oil changes, tire rotations, etc.) can cost around CAD 500 to CAD 1,000 per year. Unplanned repairs can add to this expense.

- Parking: Depending on where you live and work, parking fees can vary. Downtown parking can be expensive, with monthly rates ranging from CAD 100 to CAD 250.

When considering the cost of living in Edmonton, transportation costs play a significant role. Whether you choose public transit or car ownership, understanding these expenses will help you manage your budget more effectively.

Canadian Immigration Consultant

Need help with your immigration journey in Edmonton?

Our professional team provides personalized support to guide you through the complex process. From work visas to permanent residency, let us help you achieve your goals.

Groceries and Dining Out: Budgeting for Food

Food expenses are a crucial part of the cost of living in Edmonton. Understanding the costs associated with groceries and dining out can help you manage your budget and ensure you have enough for other necessities.

Groceries

Grocery costs in Edmonton can vary depending on your dietary preferences, shopping habits, and family size. Here’s an approximate breakdown of monthly grocery expenses for an average household:

- Single adult: CAD 200 – CAD 300

- Couple: CAD 400 – CAD 600

- Family of four: CAD 800 – CAD 1,200

Common grocery items and their average prices include:

- Milk (1 liter): CAD 1.50 – CAD 2.00

- Bread (500g loaf): CAD 2.50 – CAD 3.50

- Eggs (dozen): CAD 3.00 – CAD 4.00

- Chicken breasts (1kg): CAD 10.00 – CAD 14.00

- Rice (1kg): CAD 3.00 – CAD 4.00

- Apples (1kg): CAD 3.00 – CAD 4.00

Shopping at local farmers’ markets or discount grocery stores can help reduce costs. Additionally, buying in bulk and taking advantage of sales and promotions can lead to significant savings.

Dining Out

Edmonton offers a diverse culinary scene, with options ranging from affordable fast food to upscale dining. Here’s an overview of dining out costs:

- Inexpensive restaurant meal: CAD 15 – CAD 25 per person

- Three-course meal for two at a mid-range restaurant: CAD 60 – CAD 100

- Fast food meal (combo): CAD 10 – CAD 15

- Coffee (regular cappuccino): CAD 4 – CAD 5

Dining out regularly can quickly add up, so it’s essential to budget accordingly. For those who enjoy eating out, seeking out lunch specials, happy hour deals, and using dining discount apps can help keep costs down.

Balancing grocery shopping and dining out is essential for managing the cost of living in Edmonton. By being mindful of your food expenses, you can enjoy a variety of meals while staying within your budget.

Healthcare: Insurance and Out-of-Pocket Expenses

Healthcare is a vital component of the cost of living in Edmonton. Understanding the insurance landscape and potential out-of-pocket expenses can help you plan your budget effectively.

Public Healthcare

Canada’s healthcare system is publicly funded, meaning residents of Edmonton have access to essential medical services without direct charges at the point of care. The Alberta Health Care Insurance Plan (AHCIP) covers many basic services, including:

- Doctor visits

- Hospital stays

- Surgery

- Laboratory tests

- Diagnostic imaging (X-rays, MRI, etc.)

Residents need to register for AHCIP to access these services. While public healthcare covers many essentials, there are additional costs to consider.

Private Insurance

Many residents opt for private health insurance to cover services not included in the public system. Private insurance plans can cover:

- Prescription medications

- Dental care

- Vision care

- Physiotherapy

- Chiropractic services

- Private hospital rooms

The cost of private insurance varies depending on the level of coverage and the provider. On average, expect to pay:

- Single adult: CAD 100 – CAD 200 per month

- Couple: CAD 200 – CAD 350 per month

- Family: CAD 300 – CAD 500 per month

Employers often provide group health insurance plans as part of their benefits package, which can help reduce individual costs.

Out-of-Pocket Expenses

Even with public and private insurance, some healthcare costs might not be fully covered. Common out-of-pocket expenses include:

- Prescription medications: Depending on the drug, costs can range from CAD 20 to CAD 100 per prescription.

- Dental care: Basic dental check-ups and cleanings can cost around CAD 100 – CAD 200. More extensive procedures, such as fillings or root canals, can cost significantly more.

- Vision care: Eye exams typically cost around CAD 100, while prescription glasses or contact lenses can range from CAD 150 to CAD 500.

- Specialist visits and therapies: Visits to specialists not fully covered by insurance can cost CAD 100 – CAD 300 per session.

Understanding healthcare costs is crucial for managing the cost of living in Edmonton. By being aware of these expenses, you can plan your finances better and ensure you have adequate coverage for all your medical needs.

Education: Costs from Kindergarten to Post-Secondary

Education is a significant consideration for families and individuals moving to Edmonton. The cost of living in Edmonton includes various education expenses, from early childhood education to post-secondary tuition.

Kindergarten to Grade 12

In Edmonton, public education from kindergarten through grade 12 is funded by the government, meaning there are no tuition fees for attending public schools. However, there are additional costs to consider, such as:

- School supplies: CAD 100 – CAD 200 per year

- School uniforms (if required): CAD 100 – CAD 300 per year

- Field trips and extracurricular activities: CAD 50 – CAD 200 per activity

- Transportation: Some families may need to budget for school bus fees, which can range from CAD 30 to CAD 70 per month.

Private schools and specialized programs within the public system, such as language immersion or arts-focused schools, may have additional fees.

Post-Secondary Education

Edmonton is home to several reputable post-secondary institutions, including the University of Alberta, MacEwan University, and NAIT (Northern Alberta Institute of Technology). The cost of post-secondary education includes tuition fees, textbooks, and living expenses. Here’s a breakdown of typical costs:

- Tuition fees: CAD 5,000 – CAD 10,000 per year for undergraduate programs

- Textbooks and supplies: CAD 500 – CAD 1,000 per year

- On-campus housing: CAD 5,000 – CAD 8,000 per year

- Off-campus housing: CAD 8,000 – CAD 12,000 per year, depending on location and type of accommodation

Additional costs may include meal plans, transportation, and personal expenses. Scholarships, grants, and student loans are available to help offset these costs.

Childcare

For families with young children, childcare is an important expense to consider. The cost of childcare in Edmonton varies based on the type of care and the age of the child. Here are average monthly costs:

- Daycare for infants and toddlers: CAD 900 – CAD 1,300

- Preschool programs: CAD 600 – CAD 1,000

- Before and after school care: CAD 300 – CAD 500

Subsidies are available for families with lower incomes to help reduce the cost of childcare.

Education costs are a vital part of the cost of living in Edmonton. By understanding these expenses, you can plan accordingly and ensure your family has access to quality education at every stage.

Recreation and Entertainment: Spending on Leisure

Recreation and entertainment are essential aspects of life in Edmonton, contributing to the overall quality of living. Understanding these costs helps in planning a balanced budget that includes fun and leisure activities.

Outdoor Activities

Edmonton is known for its beautiful parks and outdoor spaces. Access to these areas is often free or low-cost, making it easy to enjoy outdoor activities without breaking the bank. Some popular outdoor activities include:

- Visiting River Valley Parks: Free

- Cycling or Walking Trails: Free

- Skiing and Snowboarding at Local Hills: CAD 30 – CAD 60 per day

- Ice Skating at Public Rinks: Free to CAD 10 per session

Sports and Fitness

Staying active is important, and Edmonton offers a variety of sports and fitness options:

- Gym Memberships: CAD 40 – CAD 100 per month

- Drop-in Sports (e.g., basketball, swimming): CAD 5 – CAD 15 per session

- Fitness Classes (e.g., yoga, pilates): CAD 10 – CAD 25 per class

Many community centers provide affordable options for fitness and recreational activities, making it accessible for residents of all income levels.

Cultural and Arts Events

Edmonton boasts a vibrant cultural scene with numerous arts and entertainment events throughout the year:

- Concerts and Live Music: CAD 30 – CAD 100 per ticket

- Theater Performances: CAD 20 – CAD 80 per ticket

- Museums and Art Galleries: CAD 10 – CAD 20 entry fee

Edmonton is also home to several annual festivals, such as the Edmonton International Fringe Festival and the Edmonton Folk Music Festival, which offer a range of activities and performances, often with free or low-cost admission options.

Dining Out and Nightlife

Edmonton’s dining and nightlife scene is diverse and caters to various budgets:

- Casual Dining: CAD 15 – CAD 25 per meal

- Fine Dining: CAD 50 – CAD 100 per meal

- Bars and Pubs: CAD 5 – CAD 10 per drink

Many restaurants and bars offer happy hour specials and other promotions, making it more affordable to enjoy a night out.

Movies and Entertainment Venues

Going to the movies or other entertainment venues is a popular pastime:

- Movie Tickets: CAD 12 – CAD 15 per ticket

- Bowling: CAD 10 – CAD 20 per person per game

- Escape Rooms: CAD 25 – CAD 35 per person

Discount days and loyalty programs can help reduce the costs of these activities.

Recreation and entertainment expenses are an important part of the cost of living in Edmonton. By being aware of these costs and seeking out deals and free activities, you can enjoy all that Edmonton has to offer while staying within your budget.

Clothing and Personal Items: Shopping Expenses

When considering the cost of living in Edmonton, it’s important to factor in expenses for clothing and personal items. These costs can vary widely based on individual preferences and shopping habits.

Clothing

Clothing expenses can range from basic necessities to luxury items. Here’s an overview of typical costs for clothing in Edmonton:

- Basic T-shirt: CAD 15 – CAD 30

- Jeans: CAD 40 – CAD 100

- Dress or Business Attire: CAD 50 – CAD 150

- Winter Coat: CAD 100 – CAD 300

- Shoes: CAD 50 – CAD 150

Shopping at discount stores, outlets, and during sales can help reduce these costs. Edmonton also has several thrift stores and consignment shops where you can find gently used clothing at lower prices.

Personal Care Items

Personal care items include toiletries, grooming products, and other necessities. Here’s a breakdown of average costs:

- Shampoo and Conditioner (each): CAD 5 – CAD 15

- Toothpaste: CAD 3 – CAD 5

- Deodorant: CAD 4 – CAD 7

- Haircuts: CAD 20 – CAD 50

for men, CAD 40 – CAD 100 for women - Cosmetics: CAD 10 – CAD 50 per item

These items can add up over time, so it’s beneficial to look for sales, buy in bulk, or use coupons to save money.

Electronics and Gadgets

Electronics are an integral part of modern life, from smartphones to laptops and other gadgets. Typical costs include:

- Smartphone: CAD 300 – CAD 1,200

- Laptop: CAD 500 – CAD 2,000

- Tablet: CAD 200 – CAD 800

These items can often be purchased on sale during major shopping events like Black Friday, Boxing Day, and back-to-school sales.

Other Personal Items

Miscellaneous personal items can include a variety of necessities and luxuries. Average costs for some common items are:

- Books and Magazines: CAD 10 – CAD 30 per book

- Fitness Equipment (e.g., yoga mat, weights): CAD 20 – CAD 100

- Household Supplies (e.g., cleaning products, kitchen utensils): CAD 5 – CAD 50 per item

By shopping smart and taking advantage of sales and discounts, you can manage the costs of clothing and personal items more effectively.

Understanding these expenses is crucial for managing the overall cost of living in Edmonton. By being mindful of your shopping habits and looking for ways to save, you can enjoy a comfortable lifestyle without overspending.

Taxes: Understanding Local and Federal Tax Rates

Taxes play a significant role in the cost of living in Edmonton. Understanding the various taxes you will encounter can help you budget effectively and plan your finances better.

Federal Income Tax

In Canada, federal income tax rates are progressive, meaning the rate increases as your income increases. For the 2024 tax year, the federal income tax rates are as follows:

- 15% on the first CAD 53,359 of taxable income

- 20.5% on the next CAD 53,359 (from CAD 53,359 to CAD 106,717)

- 26% on the next CAD 53,359 (from CAD 106,717 to CAD 165,430)

- 29% on the next CAD 63,404 (from CAD 165,430 to CAD 228,834)

- 33% on income over CAD 228,834

These rates apply to your taxable income after deductions and credits.

Provincial Income Tax

In Alberta, the provincial income tax rates are also progressive. The 2024 provincial tax rates are:

- 10% on the first CAD 142,292 of taxable income

- 12% on the next CAD 26,142 (from CAD 142,292 to CAD 168,434)

- 13% on the next CAD 52,284 (from CAD 168,434 to CAD 220,718)

- 14% on the next CAD 104,568 (from CAD 220,718 to CAD 325,286)

- 15% on income over CAD 325,286

Goods and Services Tax (GST)

Canada has a federal Goods and Services Tax (GST) of 5%, which is applied to most goods and services purchased in Edmonton. Some items, like basic groceries and prescription medications, are exempt from GST.

Property Tax

If you own a home in Edmonton, you’ll need to pay property tax. Property tax rates vary based on the assessed value of your property and the municipal budget. In 2024, the average residential property tax rate in Edmonton is approximately 0.85% of the property’s assessed value. For example, if your home is valued at CAD 400,000, you can expect to pay around CAD 3,400 annually in property taxes.

Other Taxes and Fees

- Fuel Tax: Alberta applies a fuel tax of CAD 0.13 per liter on gasoline and diesel.

- Sin Taxes: There are additional taxes on tobacco and alcohol products. For example, Alberta’s tax on cigarettes is CAD 55 per carton of 200 cigarettes.

- Vehicle Registration: The cost to register a vehicle in Alberta is approximately CAD 84 per year.

Understanding these taxes is essential for accurately assessing the cost of living in Edmonton. By knowing what to expect, you can better plan your finances and ensure you comply with all tax obligations.

Immigration news directly into your inbox

Saving Money in Edmonton: Tips and Tricks

Managing the cost of living in Edmonton effectively involves finding ways to save money without compromising your quality of life. Invest in energy-efficient appliances and use programmable thermostats to reduce electricity and heating costs. Look for bundle deals for internet, cable, and phone services to save on monthly bills. Consider sharing accommodations or renting in more affordable neighborhoods. Using online platforms to compare rental prices can help find better deals.

Utilize Edmonton Transit Service (ETS) for a cost-effective and convenient way to get around the city. Monthly passes offer significant savings if you use transit regularly. Share rides with coworkers or use carpooling apps to reduce fuel and maintenance costs. Edmonton has an extensive network of bike lanes and pedestrian paths. Biking or walking can save money and improve your health. Purchase non-perishable items in bulk from warehouse stores like Costco to save money. Take advantage of coupons, discount apps, and loyalty programs to reduce grocery bills.

Preparing meals at home is generally cheaper and healthier than dining out. Plan meals and shop with a list to avoid impulse buys. Look for restaurant specials, happy hours, and use dining discount apps to enjoy meals out without overspending. Edmonton offers many free or low-cost events, especially during the summer. Check community calendars for festivals, concerts, and other events. Utilize the Edmonton Public Library for free access to books, movies, music, and community programs. Consider memberships to museums, zoos, and recreational facilities if you visit frequently. Annual passes can offer significant savings.

Conclusion: Managing Your Budget in Edmonton

Living in Edmonton offers a unique blend of affordability, quality of life, and access to various amenities. By understanding the different components of the cost of living in Edmonton, you can effectively manage your budget and enjoy all that this vibrant city has to offer.

Key Takeaways:

- Housing: Edmonton’s housing market is more affordable than major cities like Vancouver and Toronto, offering a range of options for renters and buyers.

- Utilities: Monthly utility costs are manageable, especially with energy-efficient practices.

- Transportation: Public transit is cost-effective, and owning a car can be affordable with mindful budgeting.

- Groceries and Dining Out: Balancing home-cooked meals with dining out can help manage food expenses effectively.

- Healthcare: Understanding public and private insurance options is crucial for managing healthcare costs.

- Education and Childcare: Public education is free, but post-secondary and childcare costs should be planned for.

- Recreation and Entertainment: Edmonton offers many free and low-cost activities, enhancing the quality of life without significant expenses.

- Clothing and Personal Items: Shopping smartly for clothes and personal items can help save money.

- Taxes: Being aware of federal and provincial tax rates helps in accurate financial planning.

By carefully considering these factors and implementing effective budgeting strategies, you can make the most of your living experience in Edmonton, making it a good place to live. The affordable cost of living in Edmonton, coupled with its high quality of life, makes it an excellent choice for individuals and families alike.

Julce

Julce is an expert content writer specializing in topics about Canada, adept at blending practical advice with engaging stories that capture Canadian life.

Learn more about Edmonton

You will find helpful information about setting up in this vibrant and lively city.

Exploring Edmonton: A Guide to the Best Neighborhoods in the City

Discover the best Edmonton neighbourhoods, from historic Old Strathcona to vibrant downtown, offering unique charm and amenities.

Start Your Canadian Immigration Journey

Our experts make the process clear, stress-free, and successful, so you can move forward with confidence and focus on what matters most.

Get Started Today

"*" indicates required fields